Open Your Possible with Professional Loan Services

Open Your Possible with Professional Loan Services

Blog Article

Locate the Perfect Car Loan Solutions to Satisfy Your Economic Goals

In today's complicated monetary landscape, the quest to find the perfect lending solutions that straighten with your distinct financial objectives can be a difficult task. With countless choices available, it is essential to browse through this puzzle with a strategic strategy that guarantees you make educated choices (Loan Service). From understanding your financial needs to examining lender reputation, each step in this process requires mindful factor to consider to secure the finest feasible end result. By following a methodical strategy and evaluating all variables at play, you can place on your own for economic success.

Evaluating Your Financial Needs

When taking into consideration lending services for your economic goals, the preliminary action is to thoroughly analyze your current financial demands. Begin by examining the particular purpose for which you need the finance.

Furthermore, it is important to conduct an extensive testimonial of your present monetary circumstance - top merchant cash advance companies. Compute your income, expenditures, assets, and responsibilities. This analysis will offer a clear image of your economic health and payment capacity. Take into consideration factors such as your credit report, existing financial debts, and any upcoming expenditures that may affect your capacity to repay the funding.

In addition to comprehending your monetary requirements, it is recommended to research study and contrast the lending alternatives available in the market. Different loans included varying terms, rate of interest, and payment routines. By meticulously examining your needs, monetary setting, and offered finance products, you can make an enlightened decision that sustains your financial goals.

Comprehending Financing Choices

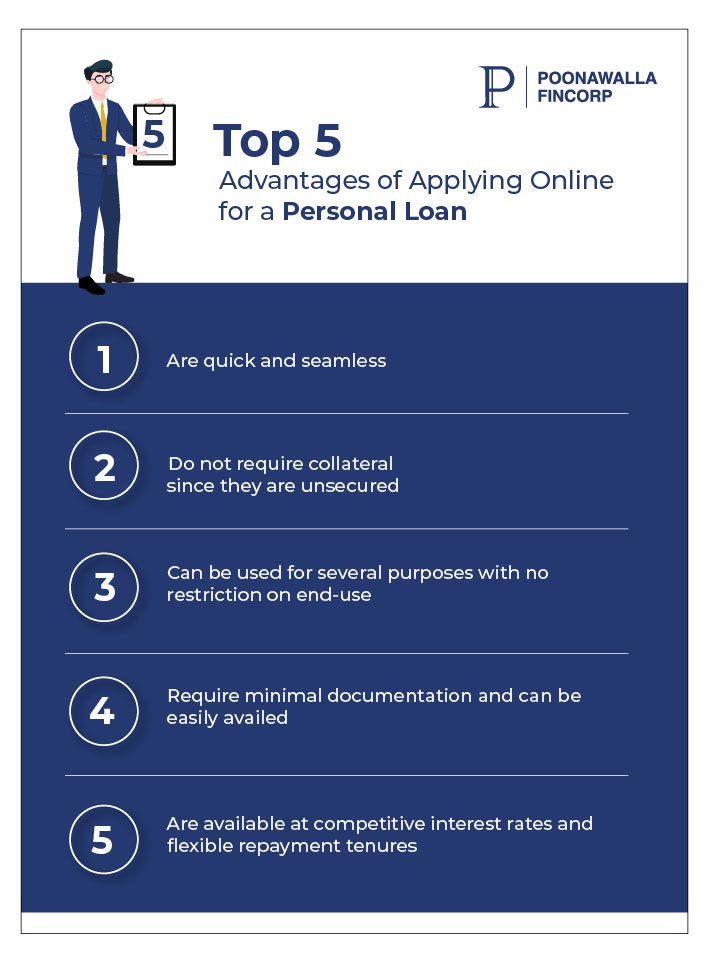

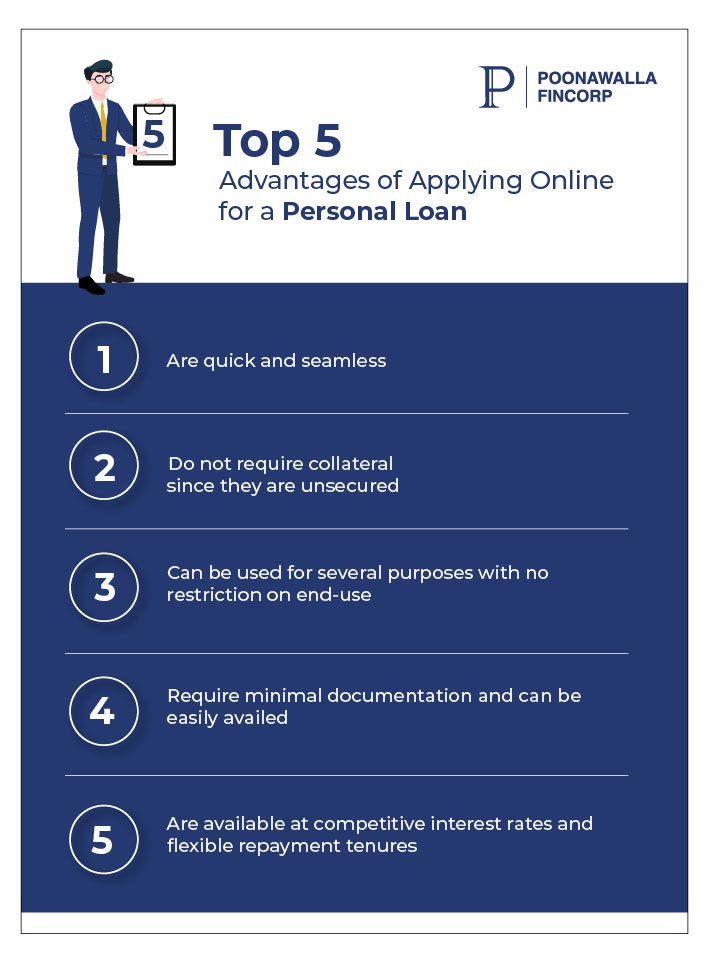

Discovering the range of financing choices offered in the monetary market is crucial for making notified decisions lined up with your particular needs and objectives. Comprehending finance choices entails acquainting on your own with the numerous kinds of fundings supplied by monetary organizations. These can vary from conventional options like individual car loans, home loans, and automobile finances to more specific items such as home equity financings, cash advance lendings, and student financings.

Each sort of car loan features its own terms, conditions, and repayment frameworks (best mca lenders). Individual fundings, for example, are unsecured loans that can be utilized for various objectives, while home mortgages are safeguarded lendings specifically created for buying property. Car finances provide to funding vehicle acquisitions, and home equity loans enable home owners to borrow against the equity in their homes

Comparing Rate Of Interest and Terms

To make informed choices relating to funding choices, a vital step is contrasting passion prices and terms provided by economic organizations. click site Comprehending and comparing these terms can aid customers choose the most ideal car loan for their economic situation. In addition, analyze the influence of finance terms on your economic goals, ensuring that the picked lending lines up with your budget and long-term purposes.

Examining Lender Credibility

Furthermore, consider checking with regulative bodies or financial authorities to guarantee the lending institution is qualified and certified with market regulations. A reliable loan provider will have a solid performance history of ethical loaning techniques and clear interaction with customers. It is likewise helpful to look for suggestions from buddies, family members, or financial consultants who might have experience with reliable lending institutions.

Ultimately, selecting a loan provider with a solid online reputation can give you tranquility of mind and confidence in your borrowing decision (merchant cash advance with same day funding). By conducting comprehensive research and due diligence, you can pick a loan provider that straightens with your economic goals and values, establishing you up for a successful borrowing experience

Choosing the very best Financing for You

Having thoroughly examined a lender's track record, the next crucial step is to carefully pick the very best loan choice that straightens with your monetary objectives and requirements. When selecting a funding, take into consideration the purpose of the financing. Whether it's for acquiring a home, combining financial debt, moneying education, or starting a service, different financings deal with details demands. Analyze your financial situation, including your revenue, expenses, credit report, and existing financial obligations. Understanding your financial wellness will certainly aid determine the type of funding you receive and can conveniently settle.

Contrast the rate of interest, loan terms, and fees supplied by various lenders. Lower rate of interest can conserve you cash over the life of the lending, while positive terms can make settlement a lot more workable. Variable in any added expenses like source costs, early repayment penalties, or insurance demands.

Choose a finance with month-to-month settlements that fit your budget plan and timeframe for repayment. Inevitably, pick a loan that not only satisfies your existing economic demands but also sustains your long-term monetary objectives.

Verdict

In conclusion, discovering the perfect car loan solutions to fulfill your economic objectives requires a detailed assessment of your monetary requirements, recognizing financing choices, comparing rate of interest prices and terms, and evaluating loan provider credibility. By meticulously considering these variables, you can select the most effective car loan for your particular situation. It is essential to prioritize your monetary goals and select a financing that straightens with your long-lasting financial objectives.

Report this page